Stress resistant due to solid capital ratios

Savings Banks are economic stabilisers in times of crisis. They had already demonstrated this impressively in the past financial crisis.

The coronavirus pandemic is once again a significant challenge for the entire economy – and consequently also for the German banking sector. The pandemic will lead to loan defaults, but it is currently not possible to reliably predict the magnitude of non-performing loans.

Overall, however, Savings Banks will cope well with these credit defaults. Germany’s 376 Savings Banks have continuously built-up reserves in recent years in order to be prepared for difficult times. These funds can be used when necessary.

The Savings Banks’ stability has recently been confirmed by the rating agency Moody’s, which pointed out the institutions’ strong capital ratios. In a specific Covid-19 stress test, Germany’s Federal Financial Services Supervisory Authority (BaFin) and the German central bank (Deutsche Bundesbank) have also confirmed that small and medium-sized credit institutions are largely stress-resistant.

Savings Banks play an important stabilising role

The corona pandemic has triggered the strongest economic shock in Germany, Europe and worldwide since the end of the second World War. In contrast to the financial market crisis in 2007 and 2008, the current crisis does not primarily affect the financial sector, but the real economy across the board – including service businesses, small and mediumsized enterprises and large-scale companies.

According to a recent economic forecast by the Deutsche Bundesbank, the decline in Germany’s gross domestic product (GDP) caused by the pandemic is estimated at 7.1 percent for the year 2020 (Deutsche Bundesbank projection of 5 June 2020).

The Savings Banks Finance Group is resilient in crises and plays an important stabilising role for Germany’s entire economy. This has been impressively demonstrated in particular by Savings Banks, most recently during the financial crisis. Since then, capital buffers have once again been significantly bolstered in readiness for economic slumps. The corona pandemic has caused just such a slump and will also have a significant impact on the balance sheets of German credit institutions.

In the past few years, Savings Banks contributed significantly to the economic upturn by granting loans. From 2018 to 2019, the volume of new loans extended by Savings Banks alone to enterprises and self-employed, for instance, increased by 4.1 billion Euro from 89.2 billion Euro to 93.3 billion Euro, i.e. by 4.6 percent.

As a result, the Savings Banks’ portfolio of loans to enterprises and self-employed amounted to 443.8 billion Euro in 2019. This corresponds to a market share of 30.1 percent. The economic slump caused by the coronavirus pandemic will probably lead to credit defaults.

“However, no-one can reliably predict when the credit defaults will show up on the balance sheets and how significant they will be”, as Felix Hufeld, President of Germany’s Federal Financial Supervisory Authority (BaFin), explicitly stated in an interview (Capital 08/2020, 16 July 2020) in mid-July 2020.

Small and medium-sized credit institutions have passed the Deutsche Bundesbank and BaFin stress test

To assess the impact of the decline in GDP on what are known as “less significant institutions (LSIs) subject to national oversight”, BaFin and the Deutsche Bundesbank carried out a stress test in July 2020 (BaFin Journal, July 2020).

The purpose of the stress test was to establish whether, and how, Germany’s approx. 1,400 LSIs – most of which are Savings Banks and cooperative banks – would be able to cope with a decline in GDP. Two scenarios were modelled in this Covid-19 stress test:

- a “quite serious decline” in GDP by 8.1 percent in 2020, which slightly exceeded the Deutsche Bundesbank’s forecast, and

- a “severe recession” with a 10.8 percent fall in GDP in 2020.

The average common equity tier-1 ratio (CET1 ratio) of LSIs was 15.9 percent before the coronavirus crisis. According to the study, the institutions were benefitting from a “solid capital base”.

In the first scenario of a serious GDP decline, the average CET1 ratio fell by 4.1 percentage points to 11.8 percent by the end of 2020, with the credit and market risk being identified as the key drivers.

In the second scenario of a severe recession, the CET1 ratio fell by 4.7 percentage points to 11.2 percent. The “greater stress effect” was due to additional losses from the credit risk.

Overall, the stress test showed that the institutions reviewed demonstrated a high resistance to stress. The study came to the conclusion that “on average, Germany’s LSIs would still be sufficiently capitalised” even if there was a severe drop in GDP by 10.8 percent. The reason is that, under the Capital Requirements Regulation (CRR), credit institutions have been obliged since January 2019 to meet the following minimum ratios, including the capital conservation buffer:

- CET1: 7.0 percent

- Tier-1 ratio: 8.5 percent

- Total capital ratio: 10.5 percent

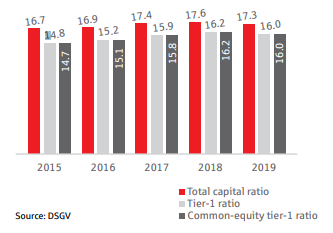

The average equity ratios of Germany’s currently 376 Savings Banks have shown a very solid level for many years and exceed regulatory requirements significantly. Between 2015 and 2019, the total capital ratio increased from 16.7 percent by 0.6 percentage points to 17.3 percent. In the same period, the CET1 ratio even increased by 1.3 percentage points, from 14.7 to 16.0 percent.

Savings Banks have thus used Germany’s economic growth in the past few years to build up reserves and to bolster their equity buffer. In fact, at the end of 2019, their CET1 ratio was slightly above the average level of Germany’s LSIs.

Like the LSIs, Savings Banks are therefore well equipped for difficult times. This does not preclude the possibility that, in specific cases, customers or sectors – and hence individual institutions – may be particularly affected by credit defaults.

Moody’s confirms significant risk buffers

In early July 2020, Moody’s Ratings also confirmed that Savings Banks could accrue eight to nine billion Euros in loan loss provisions from their revenues (Bloomberg, 6 July 2020).

According to Moody’s, this would correspond to provisions of approx. 1 percent of their gross lending volume. The rating agency compared this with the Savings Banks’ provisions at the beginning of the 2000s, when lending was affected by a downturn in the real estate market in eastern Germany. During the financial crisis in 2008, loan loss provisions had amounted to between 70 and 80 basis points.